How To Edit Prospect Scenarios

PaTMa's Property Prospect Package supports buy-to-sell and buy-to-let investment scenarios. This feature is most useful for property investors who are looking to buy a property, refurbish/repair it and selling it at an augmented price. These buy to sell investment strategies are available on the Professional and Agent subscription plans which both already allow you to create multiple buy-to-let investment scenarios.

Here's a visual walkthrough for creating a buy to sell scenario and adding your first prospective property.

Get Started

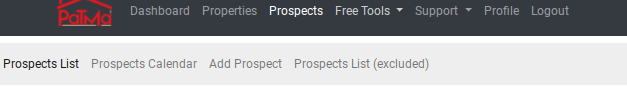

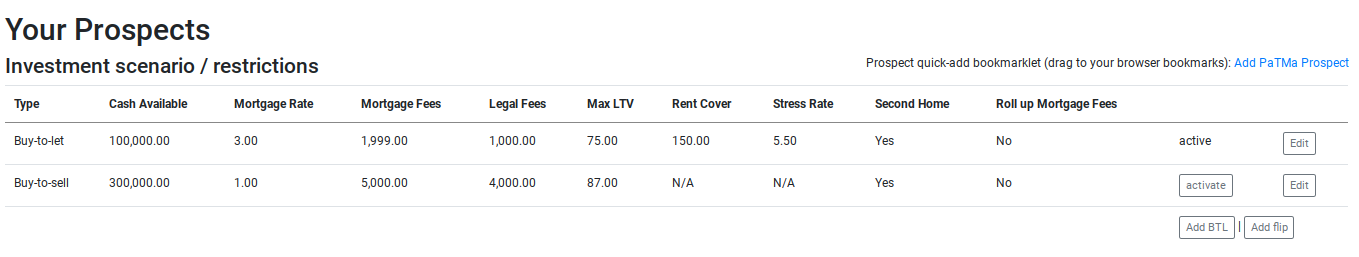

- Navigate to Prospects.

You will be redirected to a page containing your prospect listing.

- In the bottom right corner of the section Investment Scenario/Restrictions , click the button Edit .

Filling in the Form

Scenario Type

When intending to buy and sell, use the drop-down menu to select the Buy-to-Sell option.

Cash Available

In this field, enter the maximum monetary value of the finances/cash available to invest in tne deal.

Note: PaTMa will show calculations for using all of this cash, and using as little of it as possible, so your results aren't tied to this amount.

Legal Fees

Enter the fees paid to institutions in order to carry the legal aspect of both buying and selling the property. This amount can be the accumulated cost of paying solicitors and land registry.

Max LTV (%)

In this field, enter the largest allowable ratio of the loan's size to the monetary value of the property ―i.e the maximum loan-to-value ratio available from your bridging lender expressed as a percentage.

Bridging Rate (monthly %)

In this field, enter the monthly percentage monthly interest rate charged on the bridging product.

Bridging Facility Fee (%)

Enter the arrangement fee relating to the bridging loan. Most bridging loans charge a facility or setup fee based on a percentage of the loan, enter that percentage here. This is normally somewhere between 1-2% percent.

Bridging Exit Fee (%)

Depending on the bridging facility used, some lenders apply an exit fee that must be paid in order to finish the loan. If that's the case for you, enter the percentage based fee here.

Bridging Fees (£)

In this field, enter the additional fees paid for the bridging loan to be validated. This includes, but is not limited to, administration fees, redemption fees, solicitor fees and broker fees.

Selling Agent Fee (%)

If you have decided to avail of a traditional agent's services to sell the property, enter the fee paid to the agent fee in as a percentage of the sale value.

Selling Agent Fee Fixed (£)

Alternatively, if you are using the fixed price agent, enter the fixed fee that must be paid in this field.

Sales Fees

In this field, enter the costs related to the sale of the property (eg. Solicitor fees).

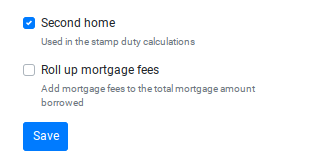

Note: In the case that this building is to be used as a Second Home, mark the box at the bottom of the page to make it blue. This information will be used in the stamp duty calculations.

Note: To add the mortgage fees to the total mortgage amount borrowed, tick the box Roll Up Mortgage Fees.

- Once completed, click Save.

You will be directed back to the prospects display page with a list of your investment scenarios and restrictions presented at the top of the page.

Note: To activate each scenario and apply it to a new prospect property, click the Activate button located at the end of each column as shown below.