Update: The LBTT and LTT rates have changed since this article was posted. Please see our updated page for current SDLT, LBTT and LTT rates, along with a free spreadsheet.

In simple terms Stamp Duty is a purchase tax you might have to pay when you buy property. But Stamp Duty Land Tax (or SDLT as it’s known) only applies in England and Northern Ireland. Scotland and Wales have their own systems of Stamp Duty which work differently and charge different rates of tax.

In this report we’ll look at Scotland’s Land and Buildings Transaction Tax and Wales’ Land Transaction Tax including how they work, what tax rates apply and how to calculate the tax payable easily.

Land and Buildings Transaction Tax In Scotland

Land and Buildings Transaction Tax or LBTT replaced Stamp Duty in Scotland in 2015. LBTT is set by the Scottish Government and the system is run by Revenue Scotland.

For residential property LBTT is charged as a percentage of the property purchase price which falls within each LBTT band as follows:

| Purchase price | LBTT rate |

|---|---|

| Up to £145,000 | 0% |

| Above £145,000 to £250,000 | 2% |

| Above £250,000 to £325,000 | 5% |

| Above £325,000 to £750,000 | 10% |

| Over £750,000 | 12% |

First time buyers can claim First Time Buyer Relief up to £175,000. But if you buy a second home or buy to let in Scotland you have to pay an Additional Dwelling Supplement or ADS. This is 4% on top of the standard rate for purchases above £40,000.

Different LBTT rates apply to non-residential property in Scotland:

| Purchase price | LBTT rate |

|---|---|

| Up to £150,000 | 0% |

| £150,000 to £250,000 | 1% |

| Above £250,000 | 5% |

Here’s Revenue Scotland’s LBTT on Property Transactions Calculator.

Land Transaction Tax In Wales

Land Transaction Tax or LTT replaced Stamp Duty in Wales in 2018. LTT is set by the Welsh Government and the system is run by the Welsh Revenue Authority.

For residential property LTT is charged as a percentage of the purchase price which falls within each LTT band as follows:

| Price threshold | LTT rate |

|---|---|

| The portion up to and including £180,000 | 0% |

| The portion over £180,000 up to and including £250,000 | 3.5% |

| The portion over £250,000 up to and including £400,000 | 5% |

| The portion over £400,000 up to and including £750,000 | 7.5% |

| The portion over £750,000 up to and including £1,500,000 | 10% |

| The portion over £1,500,000 | 12% |

If you buy a second home or buy to let, or if you’re buying through a company or trust, in Wales you have to pay the Higher Residential Rate. This is an extra 3% on top of the Main Residential Rate above. (Unlike Scotland and England there’s no concession for first time buyers.)

Different rates apply if you are buying a non residential property in Wales:

| Price threshold | LTT rate |

|---|---|

| The portion up to and including £150,000 | 0% |

| The portion over £150,000 up to and including £250,000 | 1% |

| The portion over £250,000 up to and including £1,000,000 | 5% |

| The portion over £1,000,000 | 6% |

Here’s the Welsh Revenue Authority’s Land Transaction Tax Calculator.

How To Calculate LBTT and LTT

The different systems of SDLT, LBTT and LTT have created a real headache for property investors and buy to let landlords. Not only do you have to calculate the purchase tax differently in each country. But the fact that the amount of tax payable varies in each country affects the cost of investing, your yields and whether the ‘numbers add up’ overall.

You can of course use the online calculators (or even manually calculate everything yourself) but here are some much easier ways to calculate LBTT, LTT and also SDLT automatically, saving you time and making you much more efficient.

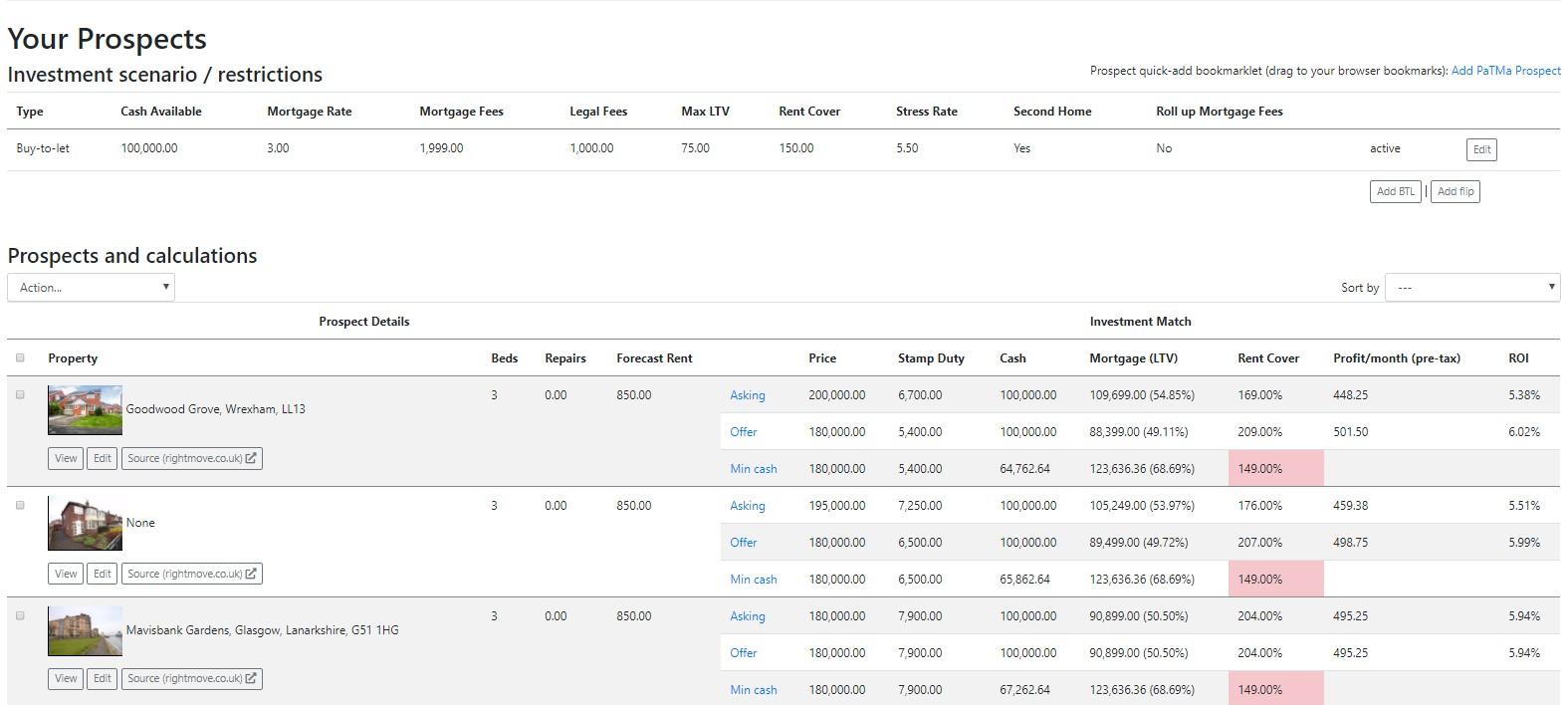

PaTMa’s tools provide full support for property purchase tax calculations. Simply enter a postcode and these tools will automatically choose which tax regime applies (even if you don’t know yourself!), allow for the fact you’re an investor, and work through the complex banding systems to produce an estimated total tax amount payable.

Here’s how to make use of PaTMa’s tools:

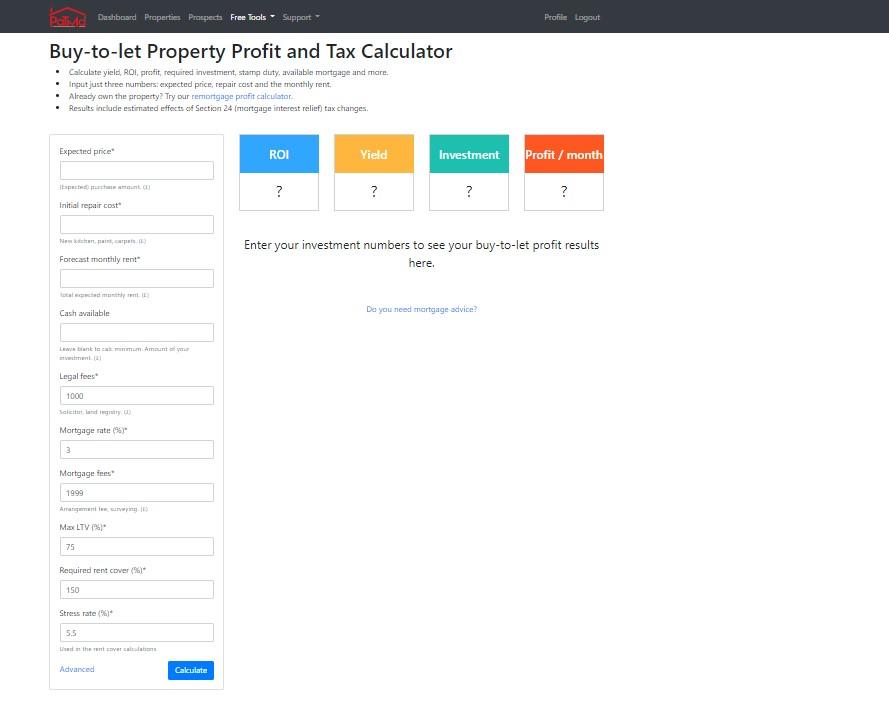

PaTMa Buy to Let Property Profit and Tax Calculator

If you just want to run through some figures – you don’t even need a specific property purchase in mind – just enter expected price, repair cost and monthly rent. PaTMa Buy to Let Property Profit and Tax Calculator will show you the SDLT, LBTT or LTT plus much more useful information. (Tip: Click on the Advanced tab to see this.)

Find the PaTMa Buy To Let Property Profit and Tax Calculator here.

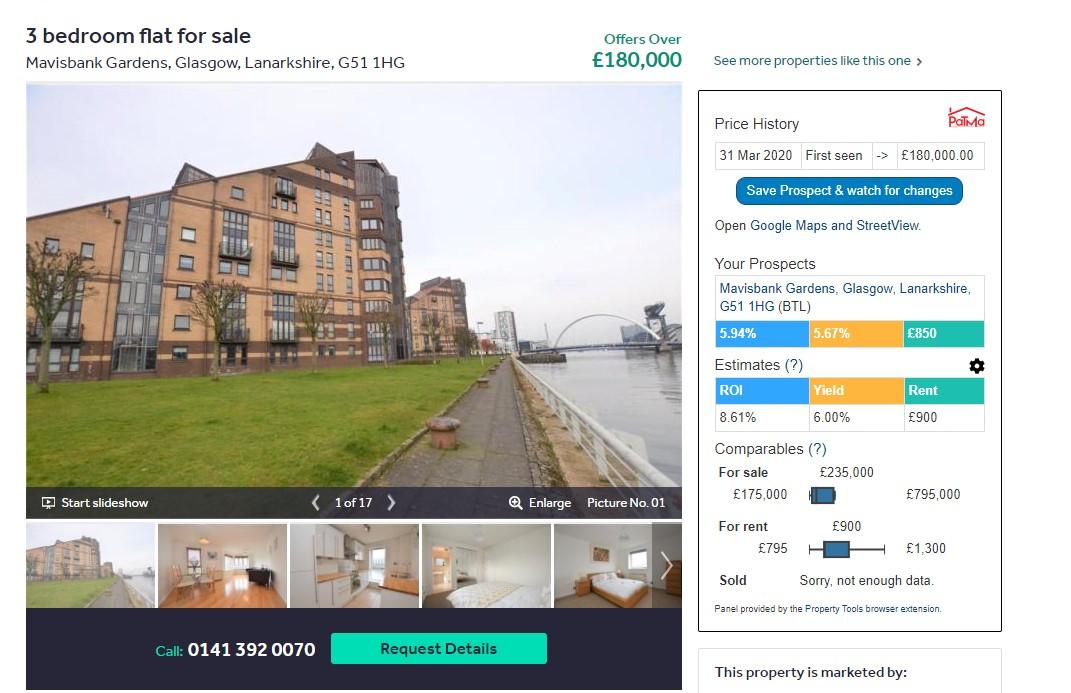

PaTMa Free Browser Extension

PaTMa’s own Property Investigation Tool works as a browser extension with Rightmove plus Zoopla and PrimeLocation. Once installed you can see price history and quick profit calculations overlaid onto every property listing whenever you search Rightmove for potential buys.

Find the free browser extension here.(You’ll need a PaTMa account but that’s also free.)

PaTMa Property Prospector

PaTMa’s Property Prospector is a powerful tool which enables you to research, analyse and track new potential properties to buy. Simply search for properties, save them as a prospect and enter some basic information. Property Prospector then automatically calculates a range of essential financial information relating to mortgages, rent cover, projected monthly profit, ROI and more. Right there amongst the data provided you will see the SDLT, LBTT or LTT payable if you decide to buy.

PaTMa Property Prospector means you can compare different properties at different prices in your chosen investment area to find which is best from a purchase tax and overall financial point of view. The tool is so smart you can even compare properties across England, Scotland and Wales to see how the tax payable and overall financial returns differ, even where the purchase price is exactly the same!

Property Prospector makes understanding SDLT, LBTT and LTT as well as the overall financial viability of a potential buy quick and simple. It is the essential research tool for all investors and landlords. Here’s full details of what the PaTMa Property Prospecting Tool can do for you.