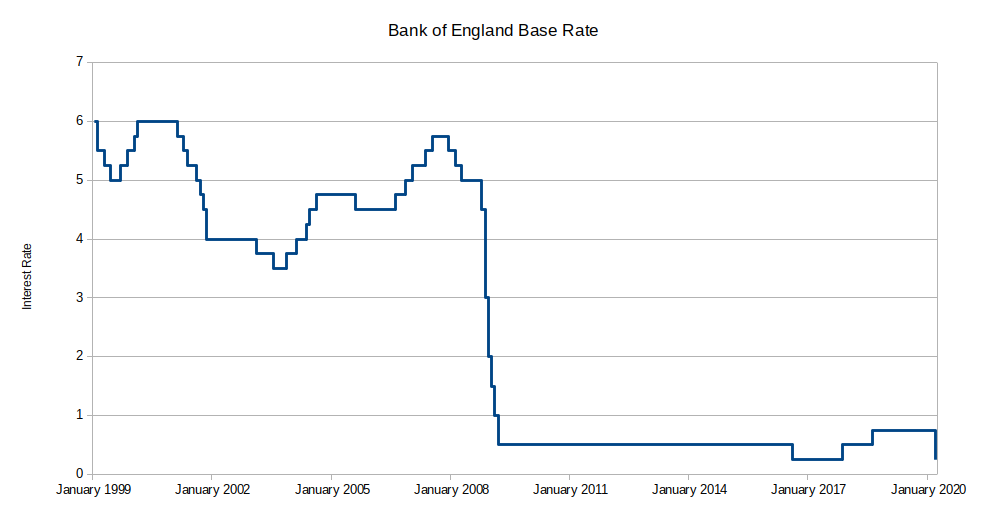

Apparently it's time for another post about interest rates! The Bank of England has announced a return to an historically low base rate of just 0.25%.

The Bank of England base rate previously dropped to 0.25% in August 2016 to mitigate the economic shock after the UK voted to leave the European Union. That rate was held for over a hear before being raised in November 2017 and then again in August 2018.

With the UK having officially entered a transition period as it departs from the European Union, the 2019 Novel Coronavirus threatening a significant economic shock of it's own, and the first budget of current Government due this afternoon; the Bank of England have concluded that a drastic base rate reduction is required to mitigate expected impacts to the economy.

Along with the base rate reduction, the Bank of England has also announced a stimulus package. It's intended that banks will use this to help businesses, especially SMEs, seek cheaper finance to help them and their employees through the short to medium economic troubles.

However we don't have long to savour the potential of this particular base rate cut, as we move straight on to the budget announcement this afternoon. We're looking forward(!) to seeing if there are any changes that affect property investors and landlords.

What will this mean for your buy-to-let portfolio?

For most investors, using fixed rate mortgages, the effect of this change won't be felt for a while. (Make sure you record fixed rate mortgage expiry dates in PaTMa so you don't miss them.)

If you've got properties on a standard variable rate or tracker rate though you'll likely see the result of this base rate reduction quite rapidly.

For trackers that mirror the reduction exactly you'll see your mortgage payments go down by almost £42 per month for every £100,000 of mortgage borrowing (assuming an interest only mortgage).

You can use the free re-mortgage buy-to-let profit calculator to see what the effect will be in your particular scenario - enter your own mortgage borrowing and your new interest rate.

Does this change your next buy-to-let deal?

You can use our free buy-to-let profit calculator and adjust the mortgage interest rate to see what effect this will have on your next projects profit.