Find the Best Deals on Your Next Investment Property

A fast and easy way to learn more about your next property and whether its a good fit for your portfolio.

Take the Guess Work Out of Your Next Property Investment

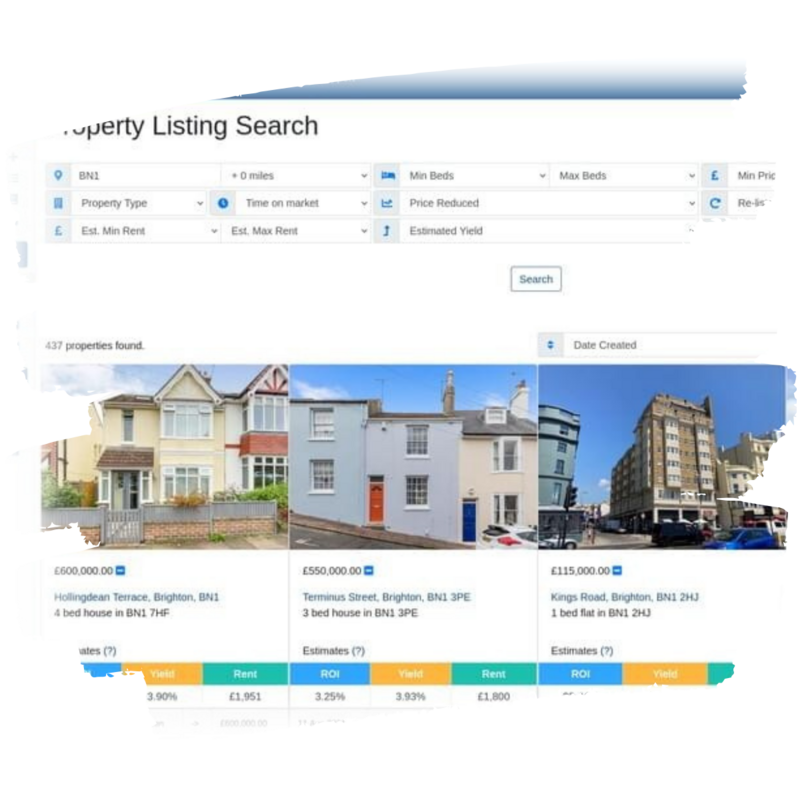

Property Investment Data at Your Fingertips

Browsing property portals? We’ll expand the data you’re seeing to reveal deeper insights. Figuring out your next refurb? We’ve got everything you need to work out your budget.

Looking at adding to your portfolio and want to know the ROI on your next property? We’ve got you covered.

Deal Finder is Loved by Property Investors:

"Thinking of starting my buy to let property portfolio and this tool has been so far really useful! Highly recommend!"

"I've used PaTMa for many months, and it's very good. It makes it very easy to research potential property investments. When there's a lot on the market, it can be a time consuming process and it really helps to identify when to deep dive. Invaluable tool."

"This is a great tool which I've been using since last year. Keep up the good work"

PaTMa’s Deal Finder Will Help You Find Your Next Property

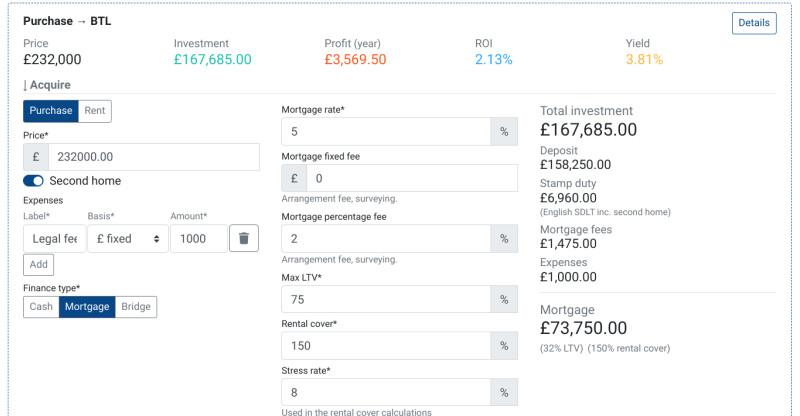

Customised Financial Analysis

Whether you’re flipping, refurbishing, re-financing, or renting, you can use deal finder to work out exactly what your next investment will mean for your finances. You can include bridging and mortgages, factor in purchase prices and ANY ongoing expenses to create an accurate financial forecast for as many properties as you want.

Get Access

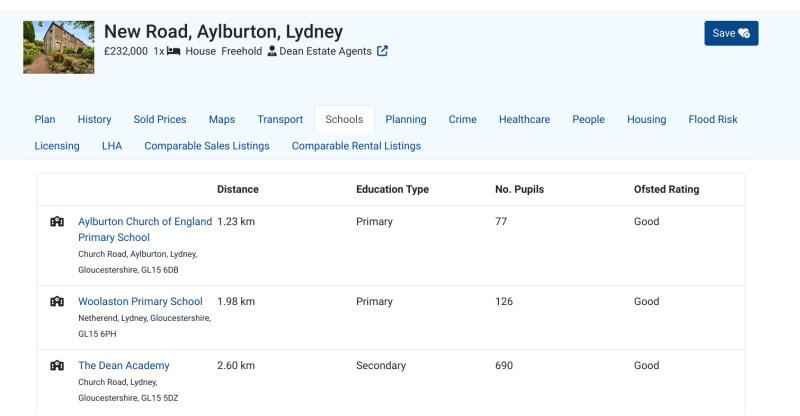

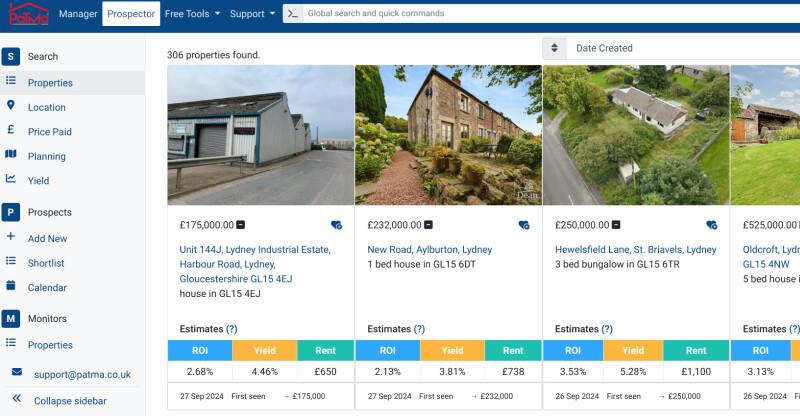

Detailed Data Insights for Smart Planning

Deal Finder will provide you with extensive UK property data, including purchase and rental comparisons, local planning applications, infrastructure links, demographics, crime, Article 4 directives, and selective licensing. You'll also learn about local councils, licensing, and more. And if that wasn’t enough you can download any of this information in a professional PDF report.

Get Access

Keep Track of Your Prospective Properties

We’ve thought of everything. You can store all the properties you’re looking at, compare finance details for them. Keep track of offers, viewings, agent actions, vendors and schedule reminders. You can even export the calendar view to your favourite calendar app.

Get Access

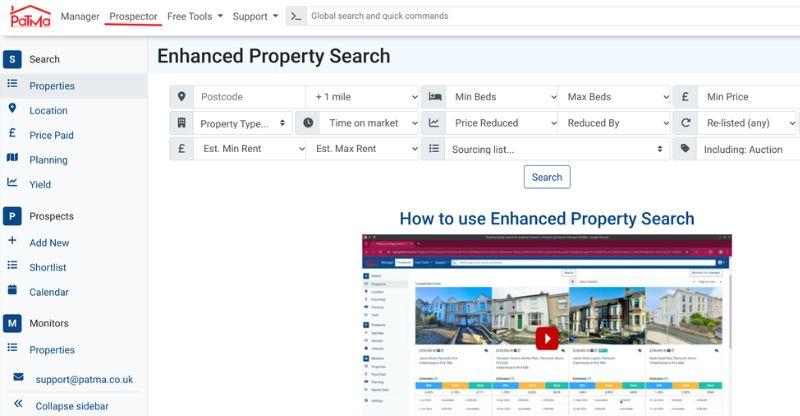

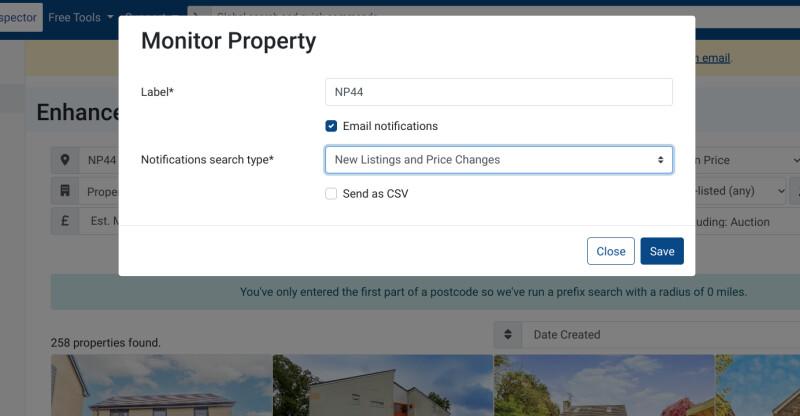

Automated Deal Finding

Set up an automated email to monitor a specific area so you get new property listings, planning applications and sold records as they happen. You can monitor as many areas as you like! And if you’re watching a particular property you can get alerts for price changes, property sales, fall throughs and any listing changes. No more refreshing portals a thousand times a day!

Get Access

Deal Finder Pricing

All plans come with a 14 day free trial. Accounts can be created without card details. No minimum term - accounts can be cancelled at any time.

Save up to £78 by paying yearly.

Extension Plus

£5

£4

/ month

£48 paid yearly, saving £12.

Instantly understand the investment potential of a property.

Starter

£18

£15

/ month

£180 paid yearly, saving £36.

Advanced search tools, tonnes of data and extra insights.

Pro

£39

£32.50

/ month

£390 paid yearly, saving £78.

For property investors looking to scale their businesses

"Brilliant extension, very useful for property investment research and information."

"Its a super-speedy time saver to save umpteen calculations and give an early sense of whether to dive in and explore a property more."

"This is a great tool which I've been using since last year. Keep up the good work"